Loan agreement between private persons

When entering a loan contract, both the borrower and the lender need to know their rights and obligations, as well as the possible consequences of violating the requirements of the applicable law. ⠀

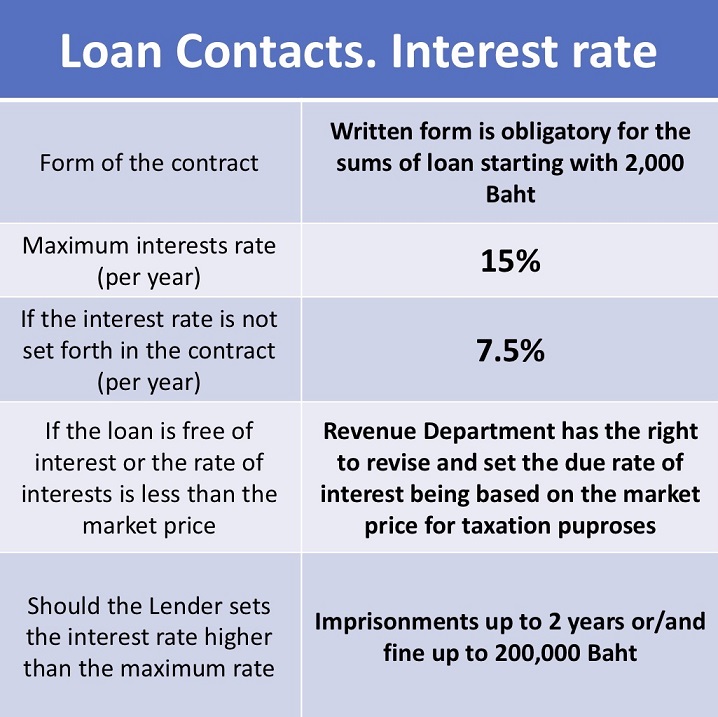

In 2017 in the Thailand promulgated the Act Prohibiting the Collection of Interest at an Excessive Rate B.E. 2560 , which imposes severe penalties

applicable to the lenders who set the interest rates exceeding the rates set by the law. ⠀

Loan contract are regulated by Book III Title IX Chapter II of the Civil and Commercial Code of Thailand "Loan for Consumption". The interest rate for such contracts may not exceed 15% per annum.⠀

If interest is set as the condition of the contract, but the rate is not defined, the general rate 7.5% per annum will be used .⠀

If the loan doesn't bear the interest at all, it is a matter is of taxation, and probably may arise if the parties of the contract are the legal entities. The revenue office may revise this condition and set the interest rate in accordance with the normal market prices (to be the income of the lender and payment of company income tax).⠀

For all the questions of the loan agreements please contact us +6694-886-74-92 (WhatsApp, Viber)

Author: Aleksandra Agapitova

All rights reserved.

Copying and use of materials without the written consent of the owner is prohibited.

English

English

Русский

Русский