New Land and Building Tax Act

The new Land and Building Tax Act B.E. 2562 came into force on March 13, 2019, and will be applied starting with January 1, 2020.

The law modifies many provisions of the previous Act as well as amends other land laws.

According to the new law, individuals and legal entities - owners of land or buildings as per the first day of the reporting year, have to land and building tax to the local administration.

The term of payment is within April of the year following the reporting year. The sum of the tax shall be specified in the notification received from the administration.

The amount of tax will be calculated on the basis of the assessed price of the land, building or condominium unit.

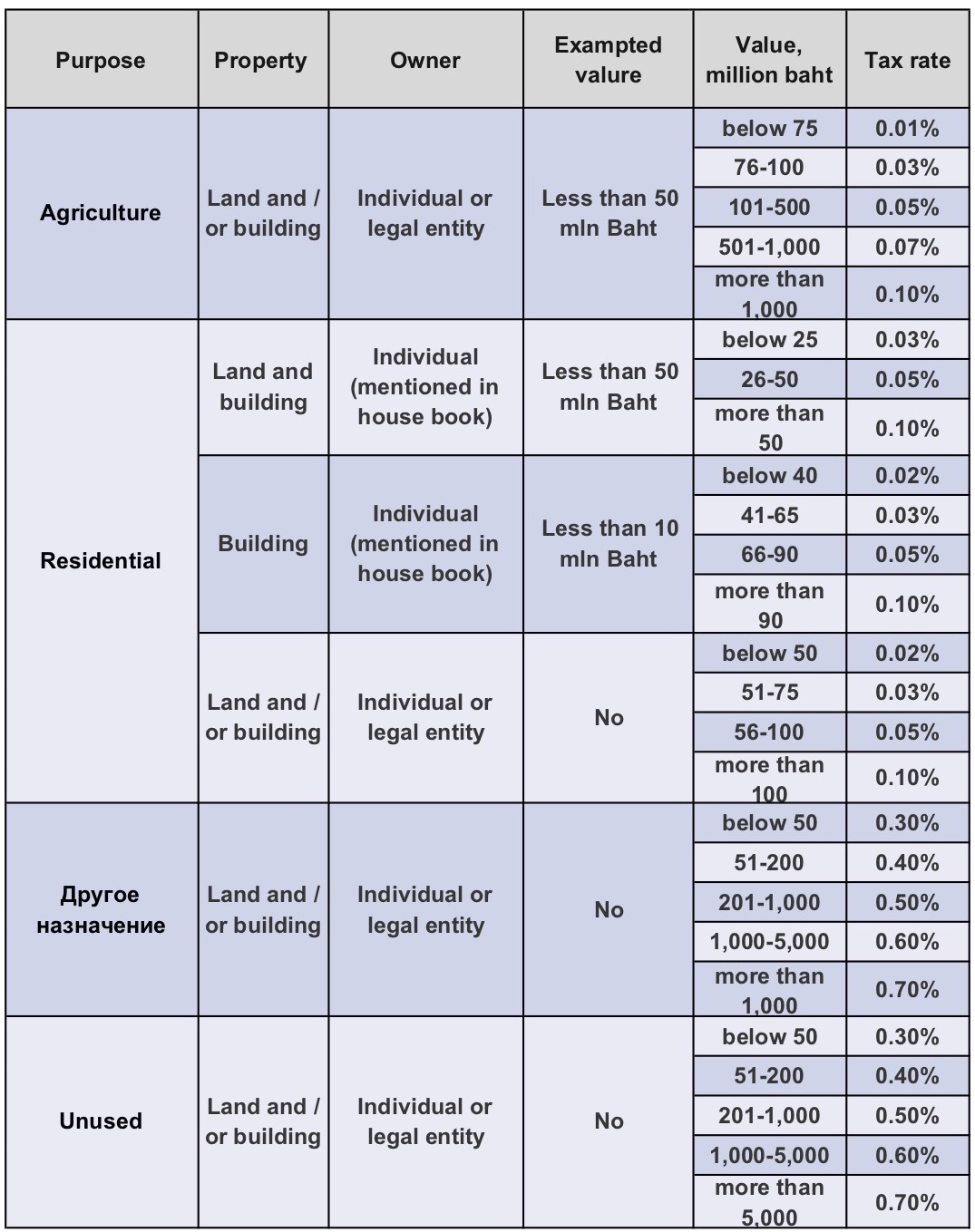

The tax rate will be determined annually by royal decree and shall not exceed the following rates:

The maximum tax rate

Agricultural property: 0.15%

Residential property: 0.3%

Other properties: 1.2%

Unused properties: 1.2%

Objects that are not used for more than 3 years: every three years the tax rate will be increased by 0.3% but not more than 3%.

Residential properties are real estate objects that are used for personal purposes. If you rent out a condominium unit, this will be "other properties". And the main requirement - the name of the owner must be indicated in the house book, otherwise tax exempt will not be applied.

Tax calculation:

Tax = (price of property – exempted price) x tax rate

Example-1

The condominium unit belongs to a private person, used by the owner for personal purposes. The name of the owner indicated in the house book.

The unit price is 12 million Baht.

Tax rate for residential buildings in 2020 is 0.02%.

Tax = (12 million Bath - 10 million Baht) x 0.02% = 2 x 0.02% = 400 Bat.

Example-2

The condominium unit belongs to a private person. The owner rents out the unit.

The unit price is 12 million Baht.

Tax rate for "other properties" (including commercial) in 2020 is 0.3%.

The exemption is not applied.

Tax = 12 million Bath x 0.3% = 36,000 Bat.

The tax rates in 2020 and 2021 are as follows:

Author: Aleksandra Agapitova

All rights reserved.

Copying and use of materials without the written consent of the owner is prohibited.

English

English

Русский

Русский